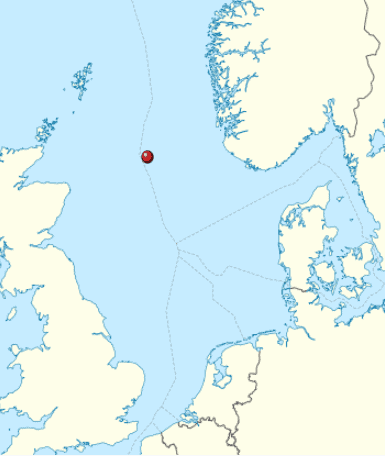

International Debut

Any history of the development of CO2 injection for greenhouse gas mitigation purposes would be remise without starting with its Nordic debut. Norway is responsible for the first carbon sequestration project developed specifically as a greenhouse gas mitigation measure. In 1991, the Norwegian government instituted a tax on CO2 emissions. Currently operated by Equinor, the CO2 gas processing and capture unit was built in order to evade the 1991 Norwegian CO2 tax. The natural gas produced from the Sleipner West field contains up to 9% CO2, however, in order to meet the required export specifications and the customers requirements, this has to be reduced to a maximum of 2.5%. Injection of CO2 at the Sleipner West field in the North Sea in 1996 was the start of the world’s first industrial scale carbon capture and storage project. Sleipner obtains CO2 credit for the injected CO2 and does not pay the tax. Since 1996 Sleipner has stored more than 16 Mt of CO2 in the Utsira formation, a deep saline aquifer 800-1,000 m beneath the floor of the North Sea.

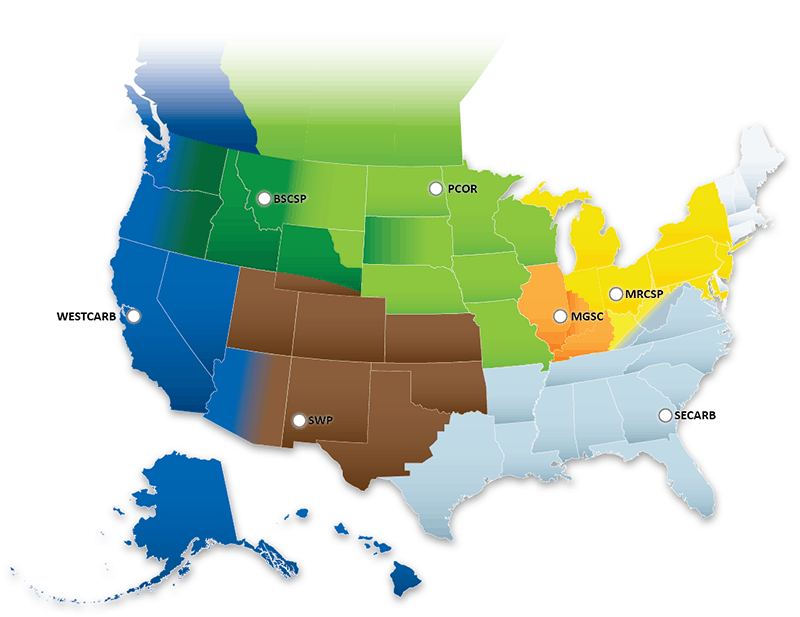

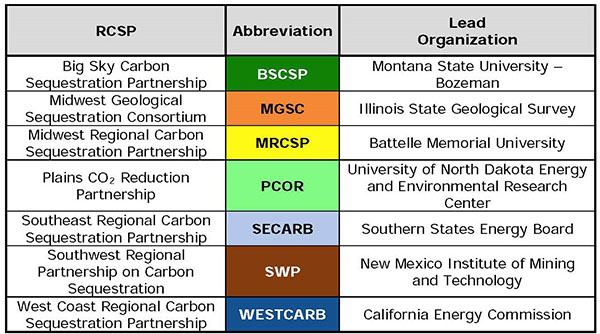

U.S. Department of Energy’s Carbon Sequestration Initiative

The DOE leads the U.S. federal government’s carbon storage research and development as part of the agency’s fossil energy programs. In 2003, DOE launched the Regional Carbon Sequestration Partnership (RCSP) Initiative to advance the development and testing of CCUS technologies in the United States. The DOE created seven regional partnerships with the intent of developing the first national network of companies and professionals focused on CCUS, raising public awareness and setting the foundations for widespread deployment of sequestration projects.

Early phases included the completion of nineteen small-scale field projects in a variety of storage complexes (eight in oil and gas fields, five in unmineable coal seams, five in saline formations, one in basalt), providing information on reservoir and seal properties of regionally significant formations, testing and initial validation of modeling and monitoring technologies. The data and experience from these pilot projects were collected in a series of Best Practice Manuals that highlighted important lessons for large-scale deployment projects.1USNETL. (n.d.). Regional Carbon sequestration partnerships (RCSP) initiative. Retrieved 10/29/2020 from https://www.netl.doe.gov/coal/carbon-storage/storage-infrastructure/regional-carbon-sequestration-partnerships-initiative

In 2008, the RCSP focus turned to large-scale field laboratories in saline formations and oil and gas fields with a target of injecting at least 1 Mt per project in the Development Phase of the RCSP Initiative. Numerous applied research technologies have been integrated into these projects and the results have been essential in further technology development of CCUS.2USNETL. (n.d.). Regional Carbon sequestration partnerships (RCSP) initiative. Retrieved 10/29/2020 from https://www.netl.doe.gov/coal/carbon-storage/storage-infrastructure/regional-carbon-sequestration-partnerships-initiative

U.S. Environmental Protection Agency Codifies CO2 Sequestration Wells

After coordinating with the DOE initiative for several years, the U.S. Environmental Protection Agency (EPA) proposed new regulatory requirements for geologic sequestration (GS) of CO2 under the Safe Drinking Water Act in July of 2008. Over the next six months the agency held two public hearings on the subject to solicit public comment. On December 10, 2010 EPA officially established a new well class, Class VI, that would allow for specific regulatory control of GS well operations.3USEPA. (n.d.). EPA Proposes New Requirements for GeologicSequestration of Carbon Dioxide. Retrieved 10/29/2020 from https://www.epa.gov/sites/production/files/2015-07/documents/fs_uic_co2_proposedrule.pdf4USEPA. (2010). Federal requirements under the Underground Injection Control (UIC) Program for Carbon Dioxide (CO 2) Geologic Sequestration (GS) Wells Final Rule. Fed. Regist., 45(237), 77230-77303. Retrieved 10/29/2020 from https://www.epa.gov/uic/federal-requirements-under-underground-injection-control-uic-program-carbon-dioxide-co2-geologic

Regulatory Primacy

The EPA is tasked by law to develop and implement environmental protective regulation in all U.S. states, territories and tribal nations. Generally, this implementation is carried out with federal funding by one of EPA’s field offices. However, states, territories and tribes can apply for primary enforcement responsibility, or primacy, from the agency. This delegates the responsibility for enforcement to the state or other local level. EPA’s approval is based on a legal and technical review of the application for primacy.

The EPA benefits from primacy by freeing up their limited resources to focus on the most critical environmental problems, while the recipient of primacy benefits by tailoring the regulatory enforcement protocols to their specific ecological or geological situation. Federal and state governments sometimes disagree on best practices for implementing regulations, and primacy awards more local control over these processes, at the cost of using state funds to exercise that control.5North Dakota Legislative Council staff for the Natural Resources Committee. (2011, September). Primacy agreements with the Environmental Protection Agency – background memorandum. Retrieved 10/29/2020 from http://library.nd.gov/statedocs/LegislativeCouncil/1391040100020111026.pdf6USEPA. (n.d.). What is UIC primary enforcement responsibility (primacy)? Retrieved 10/29/2020 from https://www.epa.gov/uic/primary-enforcement-authority-underground-injection-control-program

Primacy does not change the actual letter of the regulatory law that entities must follow, merely the agency responsible for enforcing the law. If the EPA determines that a state regulatory program is inadequate, they can resume all or a portion of the regulatory responsibility. Also, states, territories and tribes must apply for primacy separately in different regulatory areas, including well classes. Though most oil and gas producing states have primacy for Class II wells and regulate these wells under their own state programs, only a few states have successfully received Class VI primacy. Two Class VI wells, both in Illinois, are currently permitted by EPA in the United States.7North Dakota Legislative Council staff for the Natural Resources Committee. (2011, September). Primacy agreements with the Environmental Protection Agency – background memorandum. Retrieved 10/29/2020 from http://library.nd.gov/statedocs/LegislativeCouncil/1391040100020111026.pdf8USEPA. (n.d.). What is UIC primary enforcement responsibility (primacy)? Retrieved 10/29/2020 from https://www.epa.gov/uic/primary-enforcement-authority-underground-injection-control-program

North Dakota

In April 2010, months before the EPA codified Class VI wells, North Dakota became the first state in the United States to implement a comprehensive regulatory framework for carbon sequestration. Kevin Connors was appointed the North Dakota Oil & Gas Division’s Carbon Capture and Storage Supervisor in 2011 and began the application process for primacy. Even though North Dakota already had a well-established regulatory framework, it took seven years of amendments and negotiation to finalize their application for primacy. EPA administrator Scott Pruitt signed the final approval on April 10, 2018. The approval drew accolades from North Dakota Governor Doug Burgum, who said: “This long-awaited approval provides regulatory certainty and a path forward to ensure the long-term viability of North Dakota’s lignite coal and energy generation industries through carbon capture and storage, while also benefiting the environment by reducing greenhouse gases. We believe states are in the best position to regulate this activity, and the Oil and Gas Division is ready and capable to take the lead on this responsibility.”9Industrial Commission of North Dakota. (2018, April 10). EPA administrator signs final approval for North Dakota’s Class VI primacy application. Retrieved 10/29/2020 from http://www.nd.gov/ndic/ic-press/News%20Class%20VI%20primacy%20180510.pdf

Other U.S. States with Primacy

Several other states are interested in receiving Class VI primacy, but as North Dakota’s example shows, the path to approval is long even if the state already has a robust regulatory program. Several states now have primacy over Class VI wells. The Clean Air Task Force has put together an interactive online map showing the number of wells in each state with Class VI permit applications, including the phase for each project and the total storage capacity for each state.

Wyoming

In September of 2020 Wyoming became the second state to receive Class VI primacy approval, prompting comment from U.S. Senator John Barrasso (R-WY): “This final rule will give Wyoming the authority to permit many more carbon capture projects. Wyoming is blessed with an abundance of resources like coal, natural gas and oil that power America’s homes and businesses. Under the EPA’s final rule, Washington will recognize Wyoming’s expertise in capturing excess carbon and sequestering it underground.”10USEPA. (n.d.). What is UIC primary enforcement responsibility (primacy)? Retrieved 10/29/1010 from https://www.epa.gov/uic/primary-enforcement-authority-underground-injection-control-program11USEPA. (2020, September 3). In Cheyenne, EPA announces Wyoming’s primacy for Class VI Underground Injection Control Program, highlights final power plant effluent limitation guidelines rule. Retrieved 10/29/2020 from https://www.epa.gov/newsreleases/cheyenne-epa-announces-wyomings-primacy-class-vi-underground-injection-control-program

Louisiana

On December 28, 2023, the EPA signed a final rule giving the State of Louisiana primacy over Class VI underground injection wells. U.S. Senator Bill Cassidy, M.D. (R-LA) stated: “Louisiana worked to receive the authority to regulate capturing and storing carbon. This unlocks the next phase of job creation and economic development in Louisiana.”12Bill Cassidy, M.D. press release, December 29, 2023, Cassidy ‘at last’ Louisiana secures Class VI primacy, https://www.cassidy.senate.gov/newsroom/press-releases/cassidy-at-last-louisiana-secures-class-vi-primacy/

Other U.S. States

West Virginia is the fourth state (2025)13“Administrator Zeldin Approves West Virginia’s Class vi Primacy Application | US EPA.” US EPA, 18 Feb. 2025, www.epa.gov/newsreleases/administrator-zeldin-approves-west-virginias-class-vi-primacy-application. Accessed 19 Feb. 2025. to receive Class VI primacy approval. We can expect other states with storage potential (e.g., Texas) to move towards primacy as the adoption of carbon capture, utilization and storage (CCUS) practices grows nationwide.

Policy Incentives

Policy incentives for CCUS include government-sponsored research and development, as well as economic incentives. The U.S. Congress has supported carbon storage via underground injection through recent legislation directing DOE to expand activities. In addition, the federal tax credit under Section 45Q for underground carbon storage has been revised and is considered more supportive of CCUS project development.

45Q Tax Credits

U.S. Internal Revenue Code Section 45Q provides a tax credit on a per-tonne basis for CO2 that is sequestered. From 2008–2018, an incentive of $10/t for CO2 used for EOR or enhanced natural gas recovery and $20/t for CO2 geologic storage was available. This Section 45Q tax credit was capped at 75 Mt and in 2014, the IRS reported that 35 Mt had already been claimed.14USDOE. (n.d.). Internal revenue code tax fact sheet. Retrieved 10/29/2020 from

https://www.energy.gov/sites/prod/files/2019/10/f67/Internal%20Revenue%20Code%20Tax%20Fact%20Sheet.pdf

In February 2018, with the passage of the Bipartisan Budget Act of 2018, the tax credit was updated. The Section 45Q tax credit was increased to $35/t for enhanced recovery and $50/t for geologic storage by 2026. The $35 tax credit is also available for non-enhanced recovery CO2 utilization and direct air capture projects. Tax policies adopted by local, regional and state governments, such as the California Low Carbon Fuel Standard and elimination of sales tax on capture-transport-storage-related infrastructure by North Dakota, complement these federal tax incentives.15USDOE. (n.d.). Internal revenue code tax fact sheet. Retrieved 10/29/2020 from

https://www.energy.gov/sites/prod/files/2019/10/f67/Internal%20Revenue%20Code%20Tax%20Fact%20Sheet.pdf